Robinhood Stock Sees Unusual Bearish Options Bets

Robinhood's Recent Stock Movement

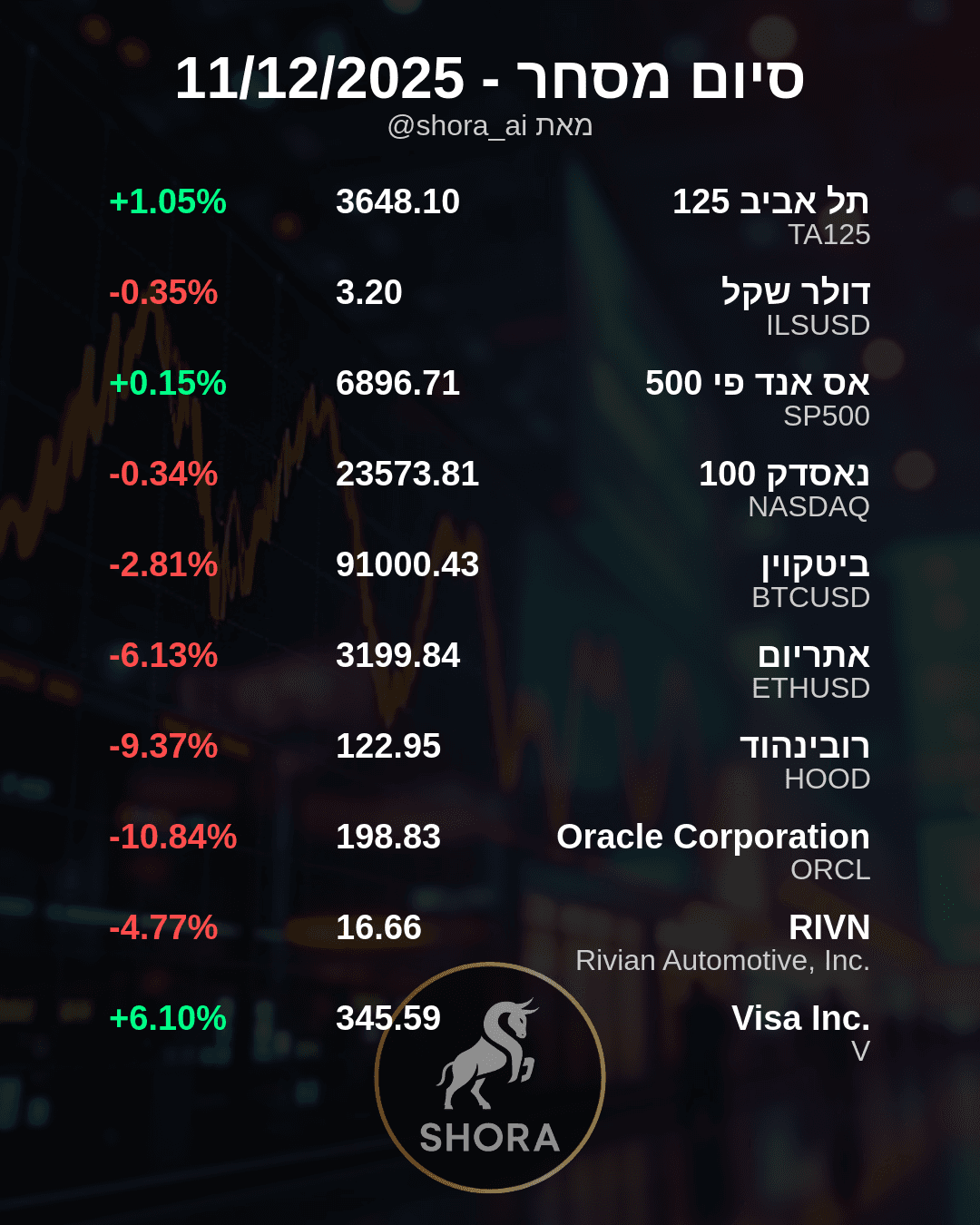

Robinhood Markets (HOOD) has recently caught attention due to unusual options activity. The company's stock experienced a fall of 0.5%, settling at $11.95. This minor dip occurred while the broader market saw a 0.0% change, highlighting a specific movement for HOOD shares.

Unpacking Unusual Options Activity

A closer look reveals a significant amount of unusual options trading for HOOD, with the overall sentiment leaning bearish. Out of 10 observed unusual trades, 6 were put options and 4 were call options. These trades involved a total volume of 1,000 contracts and an open interest of 10,000. The estimated value of these specific trades reached $1.1 million.

What This Might Signal

Such unusual options activity often indicates that larger, more informed investors, sometimes referred to as "smart money," are making notable bets on a stock's future direction. In the case of HOOD, the nature of these trades suggests that these investors might be anticipating a downward movement in the stock's price. This activity provides a potential signal for investors monitoring HOOD's performance.