Robinhood Stock Shows Strength After Q2 Results

Robinhood's Evolving Story

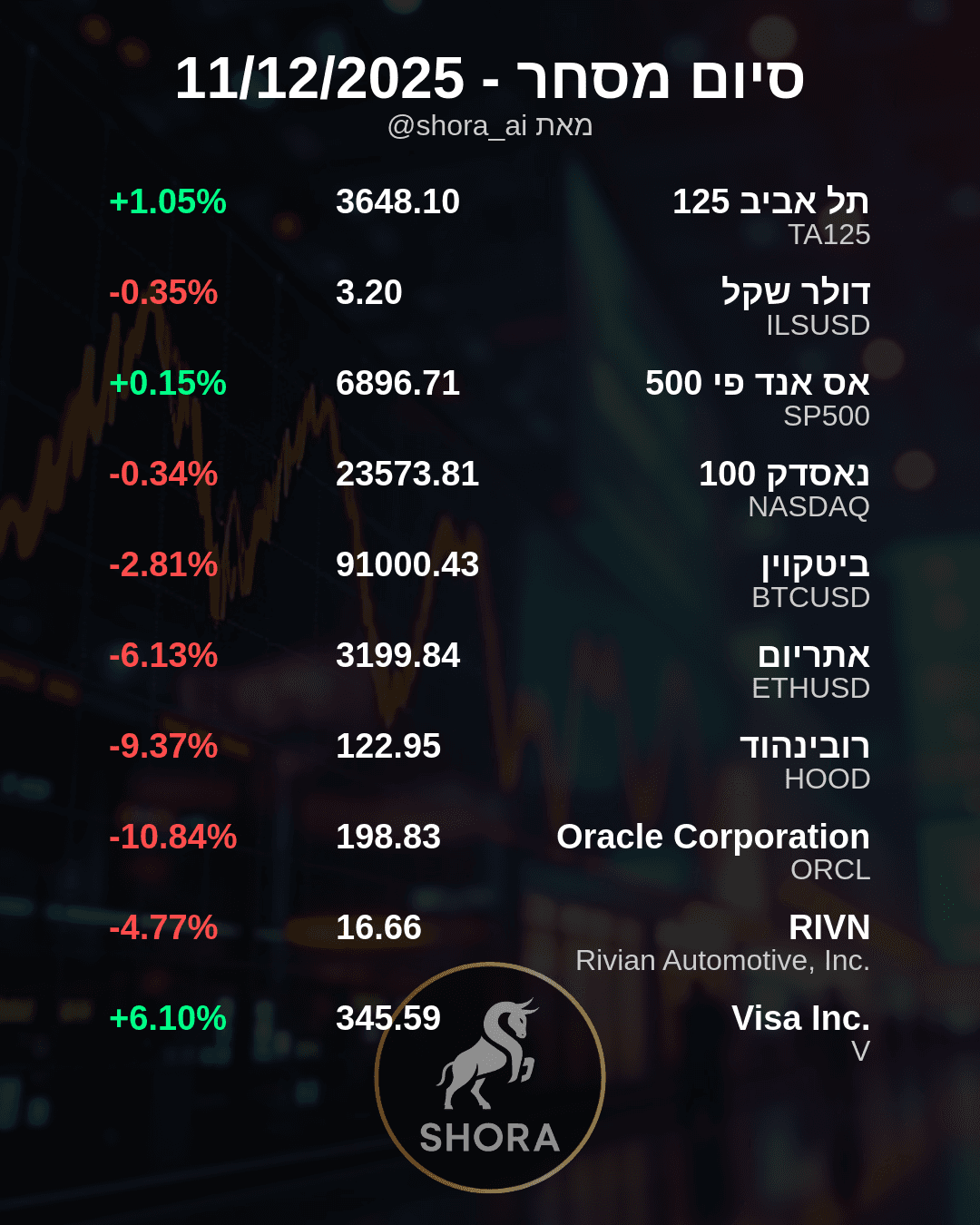

Robinhood Markets (HOOD) has been a hot topic in financial circles, with its recent performance drawing significant attention. The company's Q2 results are being highlighted as a key factor solidifying an uptrend for the stock. This comes as the platform, once known for its "meme stock" association, appears to be evolving.

From Meme to Fintech Player

There's a growing sentiment that Robinhood is shedding its earlier "meme stock" skin. Instead, it's increasingly seen as emerging as a full-fledged fintech player in the financial landscape. This shift in how the market views HOOD is a notable development, suggesting a more mature and stable business outlook. In fact, the stock has been outperforming other finance stocks this year, signaling a strong relative performance within its sector.

Optimism on Wall Street

The positive momentum around HOOD isn't just coming from its recent earnings. Wall Street analysts are also looking optimistic about the company's prospects. This optimism is reflected in the stock's current average broker rating, which stands at "Buy." For investors, this combination of solid Q2 results, a changing market perception, and favorable analyst views places HOOD firmly on their radars as a stock to watch.